TDS – TRACES REGISTERATION

- Taxgen Team

- Nov 15, 2018

- 1 min read

Updated: Oct 11, 2020

HOW TO REGISTER IN TRACES?

AfterApplying TAN you Need To Registerom TDS Traces Website

Here are the steps to register in TRACES:

Step 1:

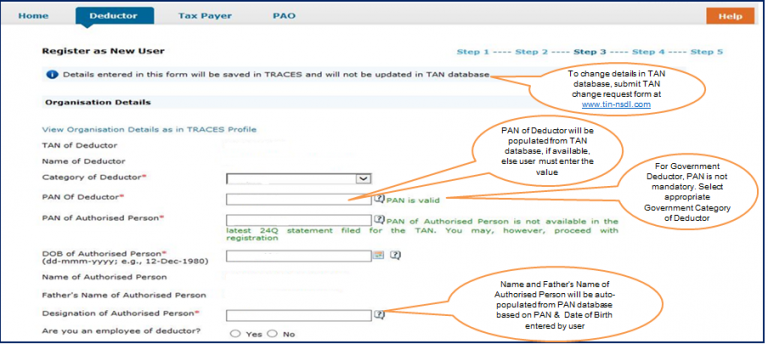

Click on “Register as New User” tab, Select “Deductor” as the type of user and click on “Proceed”.

Step 3:

Enter the Token number of the Regular (Original) Statement only, along with CIN/BIN and PAN details pertaining to the Financial year, Quarter and Form Type displayed on the screen, Token Number.

Challan details (CIN): Challan amount, Challan date, BSR code and CD record number (it is optional). Govt deductor can enter the only Date of Deposit and Transfer Voucher amount mentioned in the relevant Statement.

PAN details: Maximum of 3 distinct valid PANs and corresponding amount must be entered. If there are less than 3 such combinations, you must enter all (either two or one).

Step 4:

The authentication code is generated after KYC information details validation, which remains valid for same calendar day for same form type, financial year and quarter.

You can proceed with code, TAN, and the name of the deductor are prefilled, you will have to update PAN and responsible person details and address.

Now you can provide User ID, Password and click on “Create an Account”

Step 5:

The confirmation page will display, check all the details once. Click on “Edit” to modify the details, click on “Confirm” to continue to Registration.

Step 6:

Finally, you will receive the message “Registration request successfully submitted”. You will be received activation link and codes to the email address and mobile number provided by you during registration.

Comments